TECHNOLOGY

Why is technology so important:

At ExcluServ we know that Technology is not always the answer to your questions, but we also strongly believe that when used well, it can reduce many of the challenges you face.

However, huge amounts of time can be consumed trying to chase the “best of breed” for every slightly different situation, and in many cases, this does not have a sufficient pay-off for the effort that is consumed.

A Preferred Technology Stack:

Therefore, ExcluServ have put in the effort upfront, to identify some core systems that will in 90% of cases have a huge benefit to our outsourcing clients. This has resulted in an established Technology Stack, which we routinely implement, built around the foundation of Xero

ExcluServ continuously reviews the market for new software and system solutions that integrate with Xero, with the aim of enhancing functionality and meeting the evolving needs of our clients.

We take a proactive approach in identifying tools that streamline processes, improve reporting, and drive efficiency. Where appropriate we include those in our technology stack going forward.

Aligning wider operational systems:

Many charities have specific systems that will fall outside of the standard stack, such as CRMs, Salesforce, On-line shops and other platforms. ExcluServ have strong experience in aligning these systems to integrate seamlessly with Xero, ensuring data flows efficiently across the organization, without the need for complex reconciliations or rekeying of information

Our Back office:

Some of the most interesting technology we have introduced is behind the scenes, and gets our Nerdy personalities all excited. But, whether it is stuff that you use, or stuff that helps us run the business, it all combines to allow us to deliver the service that you need at an affordable rate and with confidence in the outputs.

WHY XERO

Xero led the way as the first feature rich, full SAAS accounting system, aimed at the SME market. We fell in love with way back when it first came to the UK in 2008, and still feel it is the best for our clients. With this commitment to the product we ensure that all of our staff are fully accredited with Xero, and that as an accounting practice we are Xero Certified Advisors and Partners.

ExcluServ is a Certified Xero partner

To really add value and deliver what is required we need your vision to be embedded in our team’s thinking. We approach outsourcing as an ongoing consultancy to enhance management information, improve business confidence and reduce costs. Our experience in other organisations is brought to the table for your benefit.

Centred on Xero cloud-based accounting software, linked to enterprise standard document management, and online payroll, ExcluServ take care of all your financial processing and management reporting.

We have found Xero to be a strong contender in each of the following areas:

-

Ledger Analysis

-

Xero offers the account code (Natural Nominal Code)

-

In addition, they offer two flexible analysis dimensions.

-

There are other options that can be used creatively such as inventory codes.

-

Multicurrency

-

Xero makes it very easy to manage multicurrency accounting

-

Multiple basis of valuing a transaction using online rates, spot rates entered at the time of recording, or rates that you enter as a background rate that will apply

-

Bank Links

-

Most online systems offer a bank link where bank transactions are automatically imported from main UK bank accounts.

-

Where the auto-upload is not possible it is still very easy to import the bank statements from a download (to Excel, CSV or OFX)

-

Xero also offers this but with many additional features around auto mapping of transactions to create the required transactions.

-

Bank batch payment options are available with several banks and new FinTech solutions.

-

Usability

-

Xero has adopted a very intuitive interface and has built in tools that are extremely easy to use that make processing much quicker and more accurate. These include mass correction tools for coding and other similar errors; auto entry from linked banking; approval stages for invoices / expenses; Repeating journals etc.

-

Extended Functionality

-

Xero has courted the wider development community from the outset to embrace their agile software development and build product extensions.

-

These can be accessed through the Xero Marketplace. This means that for almost any solution required outside of the core product there are a range of apps that can be added to Xero to extend its functionality.

-

Caveat: Xero is not perfect, but those limitations are normally no more than a frustration, and there are effective workarounds.

There will be some of our clients who outgrow it if they become exceptionally large or have onerous requirements. Typically ExcluServ are able to use technology and other solutions alongside Xero, to make it sufficient for many years. This avoids the huge cost of stepping up to an ERP system such as Business Central, which is likely to have a 3 year implementation cost approaching 6 figures.

EXCLUSERV OUTSOURCING TECHNOLOGY STACK

ExcluServ have a few “go to” software solutions from the Xero App market, that we apply. In each case, we have looked at other similar, and in some cases more well known solutions, and determined that the solution we have chosen offers greater functionality and control.

Data Entry - We have worked with Ezzybills for more than 5 years, and have found them collaborative, and open to adding new functionality that enhances their core product based on ExcluServ’s deep knowledge of what works well. As a result the software now has the richest functionality for scanning documents from a supplier and creating the appropriate entries in Xero automatically. This then allows the outsourcing team to focus on more value added checks, rather than rekeying of data.

Approval Workflows – From the outset we have been on the journey with Gunther and his team at ApprovalMax. The software goes from strength to strength, with more and more workflows that can be built, allowing you to define what goes to whom and in what situation. If implemented well, this can reduce time significantly, but also massively increase the control and improve the audit trail. Your auditors will love it and your staff will welcome the reduction in email traffic.

Card Expenses – Our biggest challenge for years was collecting receipts for credit card users and then trying to get a month end close in time. By moving to Soldo payment cards, that nightmare has become manageable. Each card holder can record the expense at the time it happens, and attach a photo through their mobile device. A central console allows you to see who has receipts missing as often as you wish, rather than waiting to the end of the month. The transactions can also be coded on the go, and when automatically synchronised to Xero, they have the all the information passed over with no manual intervention. The other challenge this has overcome, has been the replacement of petty cash (and expenses) with these cards. The cards can be held at a low unit cost and therefore can be assigned to departments for event spending etc, and can also be given to short term visitors with a per diem added that they can use and other creative approaches to reducing the admin of cash and expense handling.

Supplier Payments - When suppliers need to be paid we have now moved this entirely to Telleroo. This reduces the number of people who need to access your bank (and the bureaucracy that surrounds that), reduces the time needed for setting up payment runs on the bank and most importantly, provides a whole raft of additional controls and information for people approving the payment run. It has absolutely transformed the process and is one of the changes that our clients are feeling the benefit from on weekly basis.

Reporting – Acterys with Power BI Reporting is an area that we recognise is more complex for some of our clients than others. We can and do work at a basic level with reports directly out of Xero, or through exports to Excel where a simple solution is all that is required. However, for more complex organisations the power of a Business Intelligence solution is available, similar to what you would expect from a mid-range ERP solution (Netsuite or Business Central). We have developed a suite of reports that meets 90% of what you would need, typically “out of the box”. The strength of this is that it publishes the information that people want immediately with no manipulation, so that within minutes of a journal being processed a revised version of the monthly accounts is displayed for you. This solution also extends the limited budgeting functionality within Xero to a different level, and allows managers to update their own budgets if that is what is required.

Data Collection – Where there is a need to collect data either internally from staff or from volunteers / suppliers, ExcluServ have developed expertise in building webforms using Jotform. If you have used MS Forms or Google Forms, then this is at a different level and gives us the opportunity to build logic and workflows, and for the outcome of that data to ultimately flow into your other systems, including Xero, with no rekeying!

Data Integration – However hard we try to choose systems that integrate, there are often some systems that are proprietary to our customers and where we have no control over the interface that has been created. In these cases, we look at different ways to access the data in the source system (API or scheduled reports) and use that to create a trigger with our preferred integration tool (Make). From this we can then manipulate the data into the required format for the target system and push it in using the API through the back-end.

MORE DETAIL - TECH STACK AND HOW IT WORKS

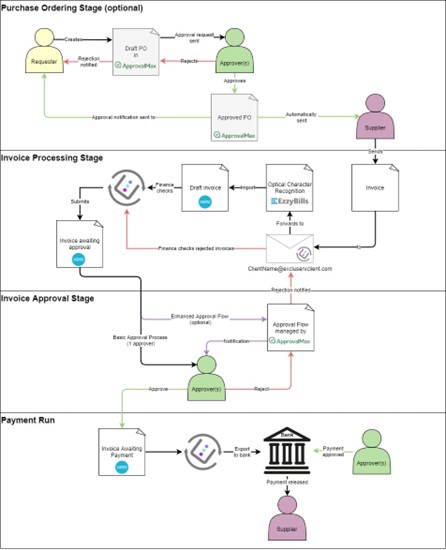

Purchase & approval process

The flow diagram below outlines a paperless purchasing process that could be done completely remotely by the different stakeholders. Furthermore, the process utilises optical character recognition technology which captures supplier invoices and greatly reduces the need for manual data entry. Each step in the process can be modified to fit the client’s needs. Each task identified with ExcluServ’s logo can also be performed in house by our clients or by us as an outsourced service. The systems included in the process flow are:

EzzyBills – optical character recognition of supplier invoices

Xero – accounting package

ApprovalMax – purchase ordering and approval flows

All these systems are integrated and allow seamless data flow between each of them.

Payment Run : “Export to bank” – read “Integrate with Telleroo” (details below)

Telleroo is a payment automation platform that helps organisations gain greater control over their payment process and reduce the need to provide direct access to their core bank account. This additionally streamlines the process, saves time and significantly reduces the risk of errors associated with other payment methods.

Here are some reasons why we use Telleroo:

Increased Controls

With Telleroo, there are a large number of additional controls, these include; Checking bank details of beneficiaries against previous payments, against the record in Xero, and against the beneficiaries bank account; Management of approval permissions from within the app; clear audit trail of approval; securely transferring data from Xero with no ability for files to be edited or amended.

Removes need for Bank Access

All access that is required by the ExcluServ team can be managed directly in Telleroo. This removes the need to setup ExcluServ staff to have online access to your main account, reducing the time this requires to manage and the additional exposure to cyber-attacks that creates.

Scheduled Payments

It is possible to setup payments and set them to be made on a specific date or time

Easy integration:

Telleroo integrates seamlessly with Xero, which can make it easy to manage your payments from a single platform.

Cost-effective:

Telleroo charges a flat fee for an agreed volume of transactions per month (then only per transaction if exceeded, with the option to upgrade for future months), which can be significantly cheaper than other payment methods, such as wire transfers or checks.

Secure:

Telleroo uses bank-level security protocols to protect your payment data and prevent fraud.

Transparent:

With Telleroo, you can track the status in real-time, which can help you stay on top of your payments.

Easy reconciliations:

The payments are integrated back into Xero which also then facilitates the reconciliation of the payments with Xero.

FinTech cards – Soldo

We highly encourage use of the new fintech cards available to streamline card payments and reduce expenses / petty cash while improving controls. Our current view is that Soldo is the best of breed for integration with Xero and we have built our internal processes around this solution.

Reporting and Planning

We adopt various reporting solutions depending on each client’s needs, ranging from Xero for basic reporting to Power BI & Acterys for enhanced reporting, budgeting and forecasting.

Xero

When it comes to reporting, Xero has built in reporting functionality that is customisable to some extent and easy to set up and use. It also provides easy drill down to transactional level, access to file attachments and view of the audit trail.

In general, reporting in Xero is designed to cater for the requirements of small and medium commercial organisations and would be sufficient for running basic Profit and Loss, Balance Sheet and cashflow reports and filter them by departments, projects and funders, depending on the system setup.

Xero also handles multi currencies quite well as it links directly with XE.com and uses live exchange rate data from there.

Challenges

Xero reporting is not sophisticated enough to replicate more complex reporting requirements like those of charities. We would evaluate on a case-by-case basis if Xero alone is a viable reporting solution. Some of the main reporting limitations of Xero when it comes to reporting and planning are:

Inability to restrict what data report users can see

Limited flexibility of report designer

No dashboard design functionality

Very limited budgeting module which requires the use of spreadsheets for multi-dimensional budgeting

No consolidation

Regardless of the limitations of Xero’s built in reporting module, there are more than one hundred reporting applications available in the application store that seamlessly integrate with Xero.

Excel

We love the familiarity and flexibility of Excel!

Xero has easy data export functionality and there are also various tools available that seamlessly integrate with Xero and Excel. This allows our clients to build custom Excel reports in a familiar Excel environment.

Challenges

The flexibility of Excel can be its biggest disadvantage when it comes to budgeting. Having multiple spreadsheets distributed to various stakeholders and then consolidating them back into the reporting software can be a nightmare for finance teams.

Also, Excel reports are generally static, so end users would not have access to live data unless a data refresh is done within the Excel template. Although dashboards can be developed in Excel, unlike other business intelligence tools, these are not interactive.

We would normally use Excel to complement Xero reporting to some extent and for simple budget templates where top-down budgeting is done. However, when our clients require live reports at a click of a button, insightful interactive dashboards, automated consolidation, bottom-up budgeting etc. we would look at a more sophisticated solution.

Acterys reporting offering

Acterys is our preferred tool for business analytics and planning.

It provides a single place for all your data into a secure Microsoft Azure cloud database. Acterys integrates with Xero and other systems (Salesforce, QuickBooks, Sage etc.) which enables consolidation of data originating in different systems.

Having all data in a single database enables consolidated reporting, modelling, forecasting, and planning in Power BI and Excel that could also be accessed anywhere through your browser or mobile phone.

There are many benefits of holding your data in a cloud enabled database but some of the main ones are:

Automated consolidation

Acterys enables automated consolidation of accounting data for multiple entities and intercompany eliminations can be automated as well. Besides that, different data sources could also be linked to the database and reported on (e.g., CRM, HR, spreadsheet etc.)

Streamlined budgeting

Having a central database to store all your budget and forecast scenarios eliminates the need to manually consolidate multiple spreadsheets. There is also the ability to create budgeting workflows.

Data enrichment

Ability to add unlimited extra layers of detail to your existing data and automate that process. For example, assume that you use the following tracker code FR_EV_DIN_EGD-2020 in your accounting software which incorporates the following information:

FR = Fundraising

EV = Events

DIN = Dinner

EGD-2020 = Eastern Golf Day which happened on 15 September 2020

These extra layers of information can be stored in Acterys and will automatically link and enrich the actual tables coming from your accounting software allowing you to run reports on Fundraising, Events, Event Types or individual events, department heads, funders and so on.

Real time access to data

The system is cloud based so you can access your data in real time and on the go from your browser or mobile phone with a click of a button

Insightful business intelligence dashboards

The benefit of keeping actual and forecasting data in a Microsoft cloud database, is that it can be easily recalled from external sources such as Excel and Power BI. We have developed standard Power BI templates that allows for powerful and interactive business intelligence dashboards. We can also build custom dashboards tailored to specific business requirements.

Comprehensive user access to data

Stakeholders could be given access to tailored Power BI dashboards and be restricted to only see the information in their dashboards and be restricted from seeing any other information.

Budget holders can be restricted to what information they can access and save back to the database.

Flexibility

The Acterys database gives full flexibility of how you can work with your data.

To really add value and deliver what is required we need your vision to be embedded in our team’s thinking. We approach outsourcing as an ongoing consultancy to enhance management information, improve business confidence and reduce costs. Our experience in other organisations is brought to the table for your benefit.